Coronavirus has had an undeniable impact on international travel and the hospitality industry.

In this article we look at the current trends and make some key recommendations to mitigate the impact upon your business.

Industry analysts at Bernstein have attempted to predict the effect upon the global hotel industry for 2020 (source Skift), estimating a profit (EBITDA) decline of 11-29% year-on-year. However, they note that the scenario includes “a near complete bounce back in 2021”, once again showing the resilience of the hospitality industry.

Our clients are remaining positive but looking to ensure they can best navigate the next few weeks and months.

Our advice is simple: don’t stop marketing your hotel, but do adapt your approach.

Current Marketing Impact

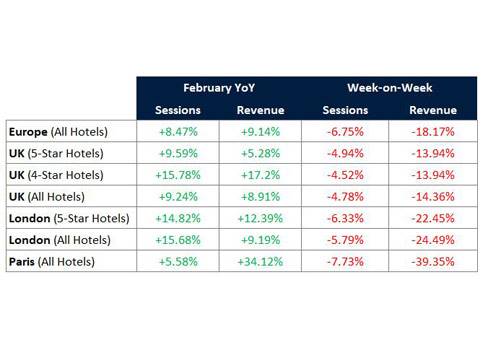

When we compare year-on-year data using our hotel benchmarking tool and a sample size of around 300 hotels, we see a relatively positive picture for London, the UK and most of Europe across the whole of the month of February. However, when we evaluate week-on-week results for the latter part of February and early March, we can see the results trending downward.

Note that week-on-week data is comparing w/c February 24th with w/c February 17th.

What this shows is, people are still actively looking at hotels, but perhaps don’t have the confidence to book right now.

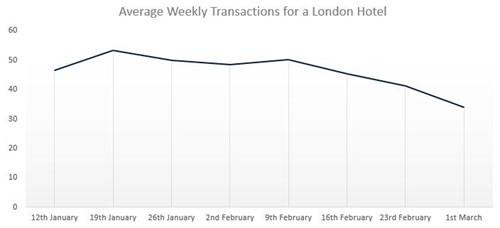

Finally, in terms of transactions, the graph below shows the average impact on weekly transactions for a London hotel during the last few weeks:

City vs. Country/Resort Properties

Comparing week-on-week results across Europe, we’ve observed a 15% drop in bookings and a 20% drop in revenue for city-based properties. Interestingly the results are largely flat for country-based properties and resorts.

These results indicate consumers are perhaps becoming hesitant to visit urban centres, but it appears to be business as usual when you move out of the city.

Recommendations

- Focus on domestic markets

Ensure maximum domestic market exposure by concentrating more budget and targeting on in-country advertising to focus on those already here, countering the impact of international travel restrictions and reduced flight timetables. Our partners, Google, have advised that search traffic for ‘staycations’ are up 50% YoY so far in 2020. - Maintain international advertising campaigns

However, anticipate lower demand which will in turn reduce the spend. - Be where the market is

Focus on metasearch advertising campaigns where there’s still an established audience with a strong intent to book. Ensure you have brand PPC covered to capture those still looking to book your hotel and have a remarketing campaign in place to convert those still undecided, but who have already shown they might be in-market. - Remove, or downplay, non-cancellable rates

Pre-paid rates are unlikely to be booked with the present levels of market uncertainty. For example, 80 DAYS are reviewing all client’s PPC accounts to identify where Early Booker or Advanced Purchase rates are being promoted and are recommending their temporary removal. - Promote a super-flexible / book with confidence rate

Look at the practicalities of allowing guests to move a booking to a new date should they wish to (reassuring new bookers as well). Evaluate your booking engine rates and descriptions to ensure that your cancellation policies, especially for flexible rates, are front and centre. Use ‘flexibility’ as one of your primary marketing messages. - Try to maintain your rates

Provided you have market parity, try to avoid reducing your rates as we all know how challenging it can be to recover this rate degradation when demand returns. Instead, look to promote added-value offers or the flexibility of your booking terms. - Reassure your guests

Highlight wherever you are going above and beyond to ensure guest safety, e.g. deep cleaning rooms etc. It’s also worth reiterating that you’re following local Governmental guidelines and best practices to minimise risk. - Prepare for the bounce back

The travel industry is resilient and we would anticipate that once the situation improves, demand should return. History, industry analysis (i.e. Bernstein’s prediction of “a near complete bounce back in 2021”) and the fact that most of us will be accumulating holidays when not travelling, would suggest that returning demand is an inevitability.

MARCH 10TH, 2020 UPDATE

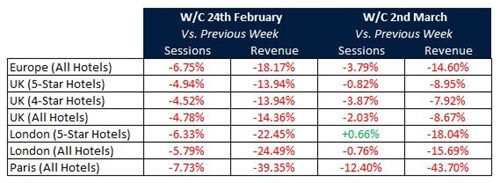

Week-on-week results continue to show the impact of Coronavirus and suggest that interest in hotels remains fairly consistent but confidence to book is low. Our advice remains the same, don’t stop marketing but do adapt your approach. Please see our recommendations above.

REMAINING 2020 UPDATES

Read our free 'Cutting Through the Noise' insight reports.

FURTHER RESOURCES

- PhocusWire have a live blog highlighting the impact of coronavirus on the travel industry

- Skift are presently running a curated live blog on ‘Coronavirus and the Travel Industry‘

- For those with Scottish hospitality businesses, VisitScotland have setup a ‘Coronavirus advice for businesses‘ page

- The World Health Organisation (WHO) continues to offer guidance on international travel