A Year of Challenges & Opportunities

2023 will undoubtedly be a challenging year for the hospitality industry, but if there's one thing hoteliers respond well to, it's a challenge.

Through a better understanding of the factors and trends affecting the industry we can turn these challenges into opportunities, so here's our rundown on some of the key hotel marketing trends and stats for the year ahead.

1. Q4 2022 sees traffic up & bounce rates down

Interest in hotels remains strong. Website sessions were up 19% on pre-pandemic (2019) levels during Q4 2022. This is especially true for 4-star properties, where website sessions were up 37%, although 5-star also grew by 7%.

Bounce rates (the % of people who immediately leave your site after visiting) were down 3% (a positive as you want people to engage with your site), although they did increase slightly for 4-star properties (+5%) versus 5-star properties (-2%).

So the positive here is that travellers are continuing to engage with hotel websites, despite a cost-of-living crisis, recession and other political and economical factors.

Source: Hotel Benchmark

2. Hotel website revenue more than doubled in Q4 2022

It's not just window shoppers. Hotel website revenue was up 99% on pre-pandemic (2019) levels during Q4 2022. This is especially true for 5-star properties (up 168%), although 4-star properties also saw strong growth (up 112%).

Conversion rates (the % of people who book on your hotel website) were up 3% overall, although 4-star hotels saw conversion drop by 6%. Conversely, 5-star hotels saw their websites converting at record levels; +14% on pre-pandemic levels.

Of course, with revenue up significantly, but conversion rate only increasing slightly we can infer that transaction values are also increasing. This will inevitably be partly due to increased rates as a result of a buoyant market, but also passed-on costs from painful cost increases across the industry. Still, the level of growth, especially in conversion for 5-star hotels, is encouraging.

Source: Hotel Benchmark

3. 55% plan to take longer trips in 2023

Quick wins here; highlight your best length of stay (LoS) special offers to attract those looking for a longer trip. Consider week-long, or even month-long, offers to attract those focused on a few longer trips, rather than multiple weekend breaks.

Source: Booking.com

4. The growth of 'blended travel'

With more 'digital nomads' than ever before, consider offering business/leisure packages to capture those looking to work and play.

Commonly known as 'bleisure', or the recently coined 'mullet travel' (business at the front, party on the back!) - this is a trend that has grown during the pandemic, with more weekends being booked than ever before. Skift reports that 38% of trips included a weekend in 2022, compared to 31% in 2019.

Source: Skift

5. Flexibility for the forseeable future

The travel hokey cokey (or hokey pokey for our US readers) caused by seemingly never-ending waves of COVID appears to have left travellers more wary of non-refundable rates.

Unpredictability has lead to 96% of travel businesses now offering refundable services or credits in a recent Expedia survey.

The ability to get a refund was 2nd only to pricing in Expedia's Traveler Value Index; flexibility will remain a top priority for guests in 2023.

Source: Expedia

7. 35.1m visitors to the UK predicted in 2023 (86% of 2019 levels and 18% higher than 2022)

While this is a UK-focused stat, it bodes well for wider European travel too. Despite the cost of living crisis, COVID, the Ukraine/Russia conflict and other political, social and economical factors, tourism projections remain reasonably buoyant.

8. Informed travellers seek better brand connection

As Skift's Sean O'Neil highlights; "In the past, travelers had less access to information, so the sign out front of a property carried more weight by conveying a promise of consistent quality. But now, every smartphone can bring up a mix of reviews and social recommendations specific to an individual property."

This levels the playing field a little for independent hoteliers who can let their brand, positioning and reputation do the talking when it comes to attracting those all-important direct bookings.

Take time to identify how your brand makes your customers feel in 2023. It's probably the most valuable part of your business and has the potential to drive significant, tangible, commercial value.

Focus on creating a deeper connection with your guests; emotive, inspirational, content is key.

Source: Skift

9. The return of Chinese travellers

Domestic travel within China is already back to 2019 levels and while Chinese tourists aren't expected to travel internationally in significant numbers until at least Q3 and Q4, there's opportunity on the horizon to capture returning demand.

How do you attract an unfair share of the market? According to recent research, destination safety continues to rank second in priority (after pricing) for Chinese travellers - so start by highlighting everything you're doing to make their stay safe and enjoyable. Lead times are also going to be shorter, so build that into your marketing plan.

10. The wealthy withstand

Strategic Vision and the ACRC (Affluent Consumer Research Company) recently surveyed high earning Americans to find that 83% of these affluent travellers said their financial stability was only improving, period-on-period during Q3/Q4 2022.

This would appear to be true for a European market too - with our initial research into the impact of the cost of living crisis upon hotel booking trends suggesting 5-star properties were less affected than 4-star and indeed the average transaction values of 5-star properties were actually increasing.

11. What about the mid market?

A more general ABTA study of the UK market found that 61% of those surveyed plan to travel internationally in the next 12 months (still down on pre-pandemic, 70%) with 57% planning a UK break (vs. 56% pre-pandemic).

Respondents who thought that the cost of living crisis would impact their holiday planning highlighted the following as potential cost saving tactics;

- 36% may take fewer holidays

- 28% may choose cheaper travel options

- 23% may eat out less

- 22% may book cheaper accommodation

- 19% may only holiday within the UK

- 19% may travel to closer destinations than usual

- 17% may do fewer activities while away

Highlight the value of your offering, including any added extras and if consumers are budgeting for less activities on their breaks, then why not pitch a 'nothing-cation' (see trend #23!)

Source: ABTA

12. Gen-Z matures

In our recent report into the hotel booking trends of Gen Z we highlighted the significant growth, both in traffic (+189%) and transactions (+257%), among the 18-24 year old demographic during the pandemic and 2022.

"In 2023, do not try to bring Gen-Z audiences into your world, but meet them in theirs." notes Google's Julia Hoffmann. "Understand their unmet needs, prioritise relevance and authenticity over homogenous singularity, and embrace the diverse, visual worlds they inhabit."

13. Travelling through TikTok

TikTok now boasts an impressive 750m monthly users and 34% of travellers stated that the platform influenced their travel planning in 2022, up 10% on 2021.

The best bit? TikTok is known to have a fairer algorithm, meaning you can achieve good results organically, without significant budget outlay.

As the Skift team note, "Small accounts have as much of an opportunity to go viral and stack video views as very large accounts because the TikTok algorithm rewards creativity, authenticity and uniqueness in travel discovery."

"Small accounts have as much of an opportunity to go viral and stack video views as very large accounts because the TikTok algorithm rewards creativity, authenticity and uniqueness in travel discovery."

Skift

14. 253 Billion views of #LearnOnTikTok to date

If you're struggling to find an angle with which to start your TikTok channel, why not begin with some educational content in 2023, using the hashtag #LearnOnTikTok?

Think Chef's guides to creating dishes, Front of House showing how to provide the perfect guest's welcome, how to handle challenging guests (behave!) and more.

15. While we're on TikTok, go behind-the-scenes!

Kill two birds on social media (pretty sure there's an Elon Musk pun we could make here) and tackle the recruitment challenge head on, while building your TikTok following using the trend of 'behind-the-scenes' style content.

Be authentic, relatable and showcase what it's like to work in the wonderful world of hospitality. Why not give your marketing team palpitations and let members of the operational team 'takeover' your TikTok for a day? Sorry marketing team.

16. Travel content drives highest engagement on Instagram

With an engagement rate of 1.41%, travel content tops the engagement charts on visual platform Instagram.

If you've neglected your social media channels in 2022 (and it certainly seems like they may need a little love - see trend #21) then it's time for change.

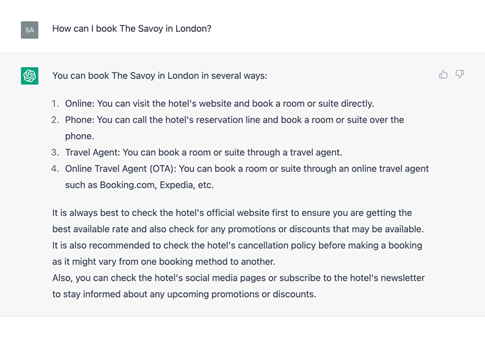

17. Robo-marketer

One of the most discussed emerging trends has to be Generative Artificial Intelligence (AI) and the buzz surrounding ChatGPT, the technology from OpenAI that's already attracted the attention of Silicon Valley's biggest investors.

In plain English, can you imagine giving a computer a set of rules and requirements and it being able to generate (actually useful) marketing assets for you? Terrifying? Exciting?

AI is evolving and it's potential use within travel could be game-changing. As Skift note: "It could generate personalized advertisements, predict customer behavior to inform the best marketing strategies for targeted demographics, and provide personalized customer service."

One to watch. In the meantime, at least it's encouraging users to book direct!

Source: Skift

18. Hoteliers are spending nearly 2.5X on Google Ads

As the market becomes increasingly competitive and the Online Travel Agents (OTAs) sink more and more budget into paid search, hoteliers are now spending 2.5X what they were pre-pandemic. In Q4, 2022 the average spend was £4,840 vs. £2,044 in 2019.

On average, Google Ads generated £27k for hoteliers in Q4, 2022 compared to £17k in 2019. This represents a drop in Return On Investment (ROI), highlighting the need for strong paid search management to maximise the returns of your media budgets in the year ahead.

Source: Hotel Benchmark

19. Mobile now accounts for over a third of bookings

Mobile usage has rocketed during the pandemic. Pre-pandemic (in Q4, 2019), mobiles accounted for 25% of all hotel website transactions. That figure is now 34%.

This trend has been particularly pronounced for 4-star hotels, where mobile accounted for 38% of transactions in Q4,2022 vs. 26% pre-pandemic. 5-star hoteliers saw 30% of all transactions come from mobile in Q4, 2022 vs. 23% pre-pandemic.

Take time to review your hotel's booking experience on mobile and use tools like Google Analytics to identify any potential conversion barriers.

Source: Hotel Benchmark

20. Email accounts for 12% less traffic in 2022

Pre-pandemic, in Q4 2019, email accounted for an average 0.61% of all hotel website traffic. In 2022 that figure was 0.54%, down 12%.

Your own database and first-party data is going to become increasingly important as third-party cookies are retired this year. Make sure you're capitalising on your owned data with good CRM management and strong email marketing campaigns in 2023.

Source: Hotel Benchmark

21. Social media accounts for 26% less traffic in 2022

Pre-pandemic, in Q4 2019, social media accounted for 2.3% of all hotel website traffic. In 2022 that figure was just 1.7%, down 26%. This drop is true for both 4 and 5-star properties.

4-star saw 1.7% of traffic from social media in 2022 vs 2.2% in 2019, with 5-star seeing 1.8% in 2022 and 2.5% in 2019.

As we've highlighted before, during challenging market conditions it's more important than ever to maintain a consistent dialogue with your guests through strong social media management.

Source: Hotel Benchmark

22. Let's get the first-party started...

In response to growing concerns over data privacy, and following in Apple and Firefox's footsteps, Google is set to phase out third-party data in 2023.

This represents both a challenge and an opportunity. You can begin to fill the data-gap using Google Analytics 4 (set it up now!) before Universal Analytics is retired in July. You should also take time to consider your first-party data needs for this year and beyond and ensure you have everything you need to inform your future marketing activity. Get started here.

23. 96% of guests want to do absolutely nothing

While it's tempting to upsell wonderful amenities and incredible local experiences that make for more memorable trips, recent research from Expedia suggests that doing 'nothing' is just as important, especially after a busy holiday season.

Indeed, 96% of those surveyed said they enjoyed 'doing nothing', with 62% flagging 'doing nothing' as their favourite part of a vacation!

So, while it's always worth highlighting everything they could do, also remind your guests that they can sit back, relax and binge Netflix while ordering room service on their perfectly-chilled, 'nothingcation'.

Source: Expedia